child tax credit october 2021

October Child Tax Credit payment kept 36 million children from poverty Data Release Nov 30 Written By Barbara Lantz The fourth monthly payment of the expanded Child. That means if a five-year-old turns six in 2021 the parents will receive a total credit of 3000 for the year not 3600.

Why You Didn T Get Your August Child Tax Credit Payment

Families with qualifying children will receive 3000 for each child age 6 to 17 and 3600 for each child under 6.

. Change language content. For families with qualifying children who did not turn 18 before the start of this year the 2021 Child Tax Credit is. Married couples filing a joint return with income of 400000 or less.

The ARPA increased the CTC from 2000 to 3000 per child for children between 6 years and 17 years and 2000 to 3600 for children below 6 years. The Child Tax Credit underwent a significant change in 2021. The law requires nearly half of the credit to be sent in advance which is.

2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C. To be a qualifying child for. That depends on your household income and family size.

The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger. Likewise if a 17-year-old turns 18 in 2021 the parents are. October can scare up several reasons to think about taxes including wondering when the next child tax credit payment will arrive.

All eligible families could receive the full credit if. That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17. Calculation of the 2021 Child Tax Credit Earned Income Tax Credit Businesses and Self.

These people qualify for a 2021 Child Tax Credit of at least 2000 per qualifying child. 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic B. The age limit was also.

October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion. This historic support the largest ever credit is. Most families are eligible to receive the credit for their children.

Eligible families can receive a total of up to 3600 for each child under age 6 and up to 3000 for each one ages 6. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States.

In 2020 and earlier years it was a credit of up to 2000 per child and was claimed on your tax return. 3600 for each child under age 6 and 3000 for each child ages 6 to 17. Families with a single parent also.

To get money to families sooner the IRS is sending families. This summer the Biden-Harris administrations American Rescue Plan Act increased the 2021 Child Tax Credit CTC. New Yorkers who received the Empire State Child Credit andor the Earned Income Credit on their 2021 state tax returns are eligible for the new stimulus check.

All eligible families could receive the full credit if. For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from a few days. The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger.

Visit ChildTaxCreditgov for details. Most families will receive the full amount. Eligibility for Advance Child Tax Credit Payments and the 2021 Child Tax Credit These updated FAQs.

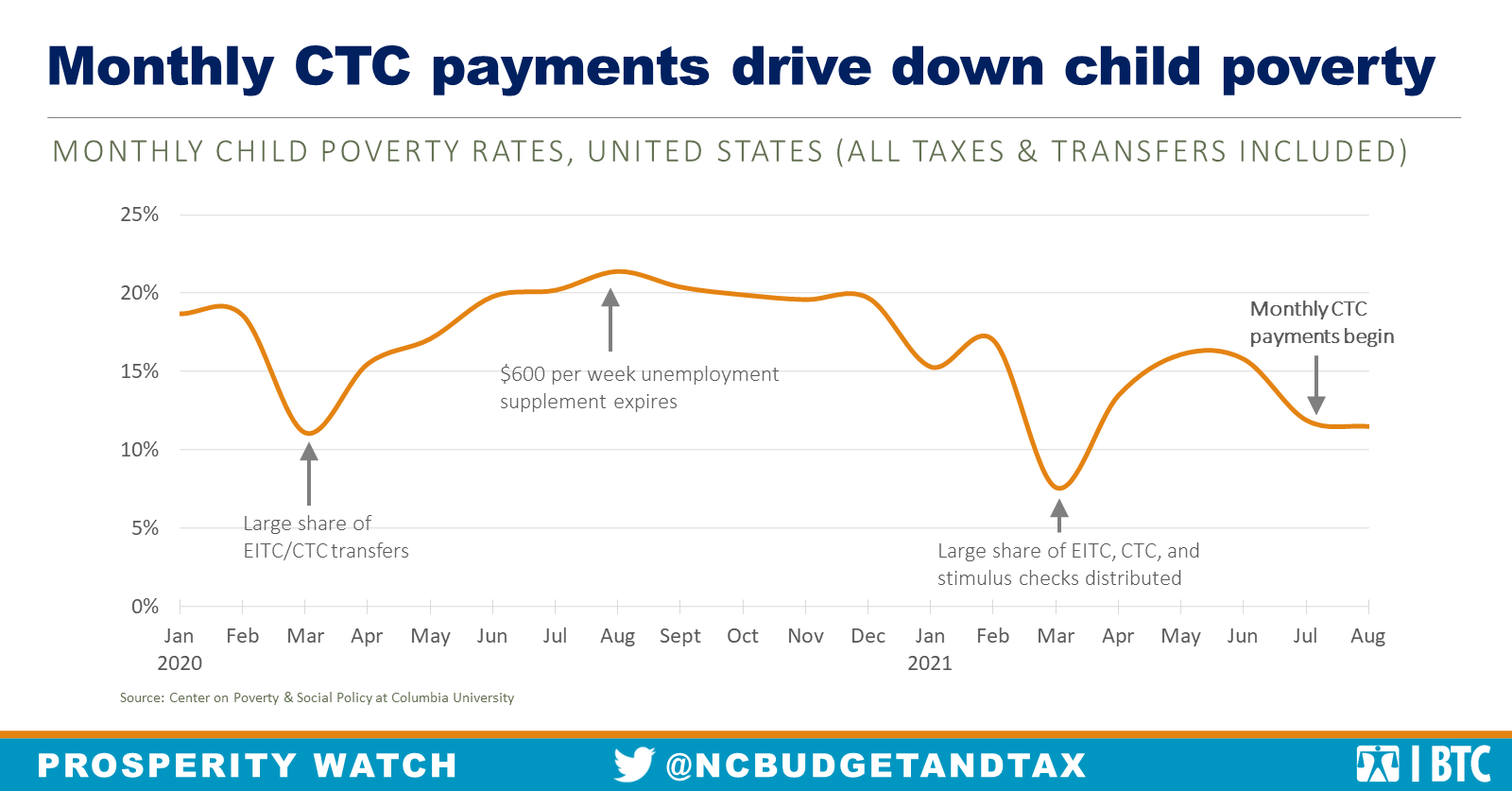

3 7 Million More Children In Poverty In Jan 2022 Without Monthly Child Tax Credit Columbia University Center On Poverty And Social Policy

Child Tax Credit Payments Other Cash Benefits Lead To A Decrease In Child Poverty North Carolina Justice Center

Are Black And Latine Families With Babies Feeling Relief From The Child Tax Credit October 2021 Frank Porter Graham Child Development Institute

Tax Tip 2021 Advance Child Tax Credit Information For U S Territory Residents Tas

Sign Up For The Child Tax Credit Before November 15 2021 Chinese American Planning Council

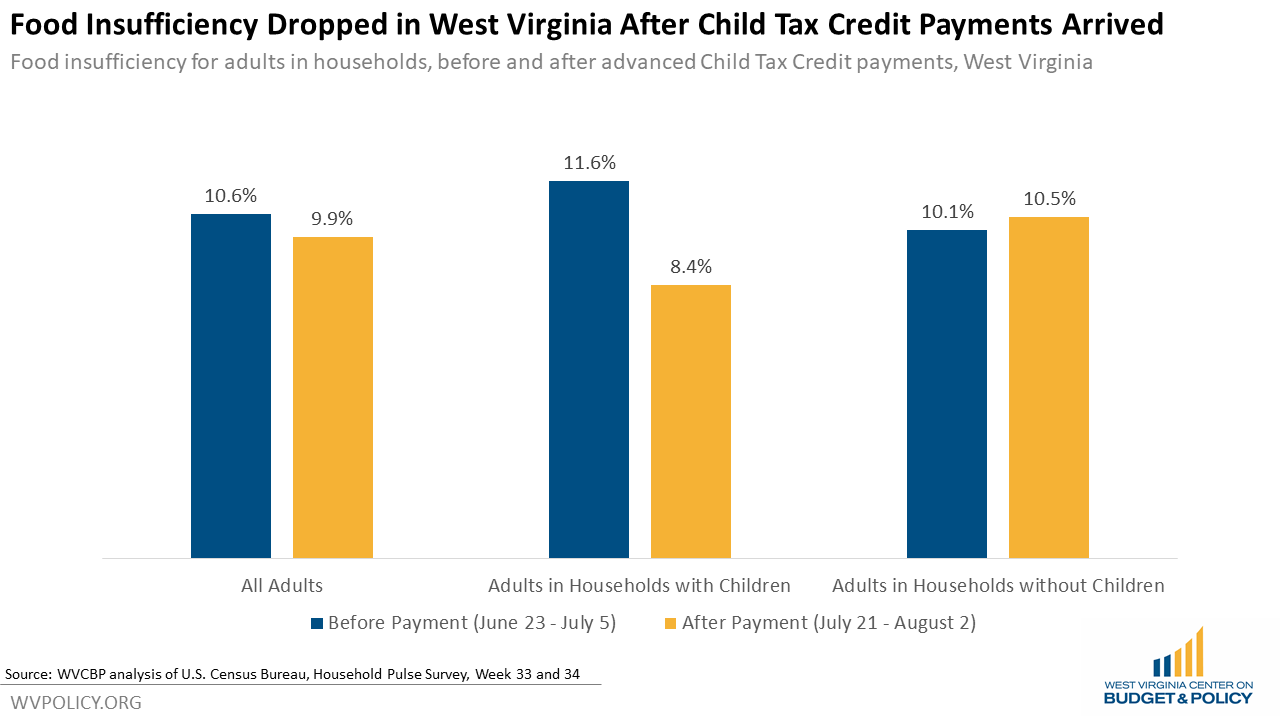

Data Already Showing Positive Impacts Of Child Tax Credit Though More Can Be Done To Ensure Benefit Reaches All Children West Virginia Center On Budget Policy

October Child Tax Credit Payment U S Gov Connect

Child Tax Credit 2021 Update Families To Receive At Least 300 If They Register For Relief Funds In The Next Five Days The Us Sun

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Payment Schedule For 2021 Kiplinger

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

![]()

Opinion Fed Data Shows Families Fared Better When Child Tax Credit Came Monthly Maine Beacon

You May Be Surprised By Cuts In October Child Tax Credit

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities

Eligible Families Can Expect Child Tax Credit Payments For October

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

New Study Finds Advance Child Tax Credits Reduced Us Food Insufficiency By 26 Center For Antiracist Research

Child Tax Credit October 2021 Payment What To Do If I Haven T Received It As Usa